This publication is intended for U.S. audiences and is not for those in the European Economic Area or the United Kingdom.

Removal of Third-Party Cookie and Privacy Legislation Drive Global Insourcing

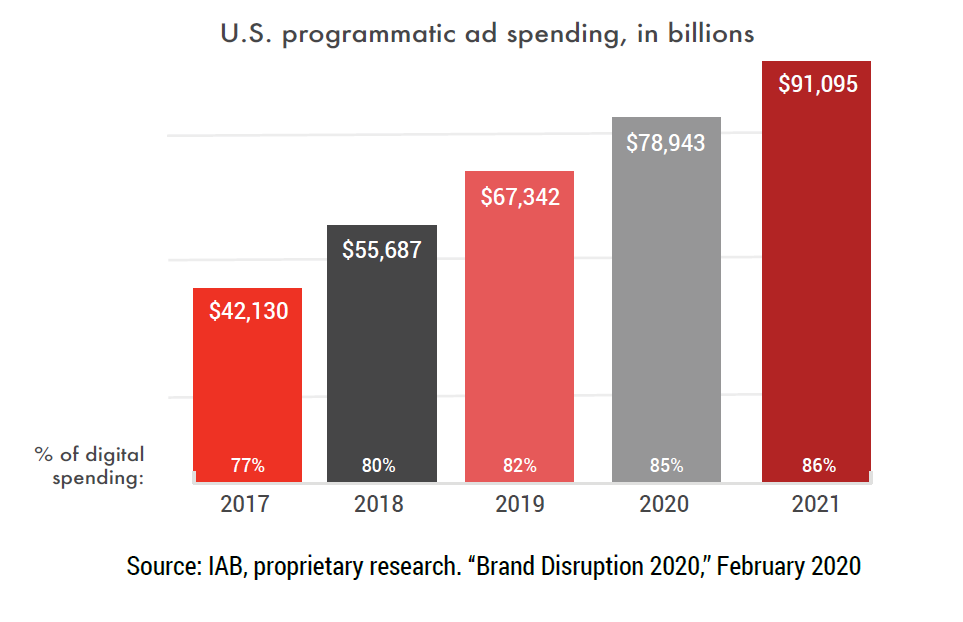

With programmatic ad spend in the U.S. set to hit $91 billion by 2021 (accounting for 68% of digital media advertising) and third-party cookies vanishing, nearly two-thirds of all U.S. brands have insourced some or all programmatic advertising.

The “IAB International Report on Programmatic In-Housing” created by the IAB Programmatic+Data Center in partnership with Accenture Interactive, reports that insourcing efforts are more strategic and cooperative. The role of agencies remains vital, especially if they are able to retain hard-to-find programmatic talent and offer niche specializations.

As the industry braces for the loss of third-party cookies and audience identifiers, direct engagement in programmatic advertising matters more than ever. Brands aren’t generally taking over the whole process, but they are taking over the development of a programmatic strategy to strengthen customer connections and to control both first-party data and functions that relate to legal and regulatory compliance.

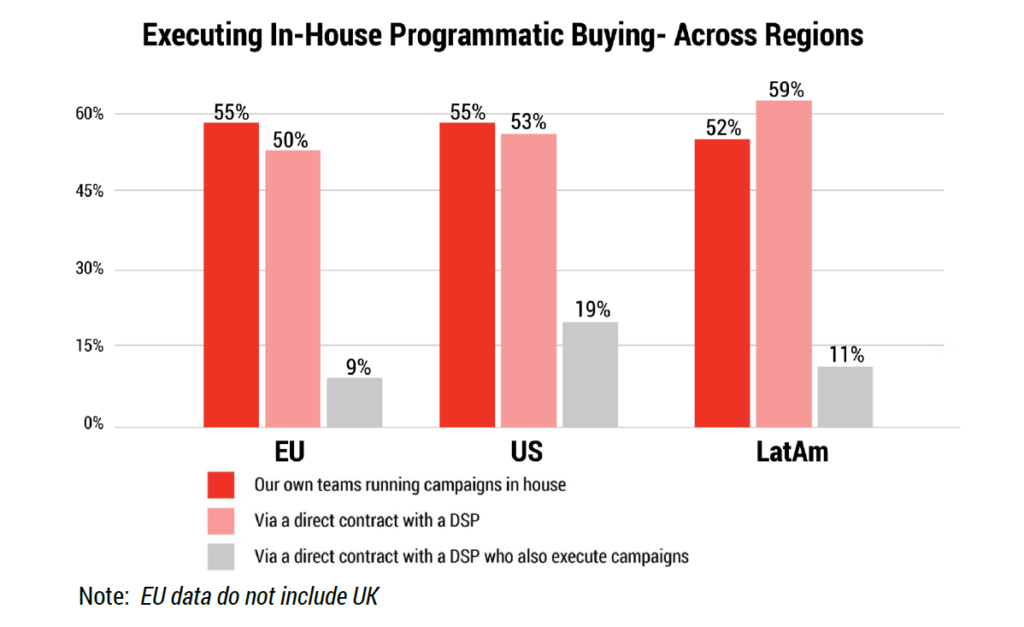

The United States vs. the European Union

In the U.S., almost a fifth of brands have completely moved programmatic advertising in-house in 2019. Over half (51%) are taking a hybrid approach, shifting some functions in-house while letting partners handle others, which is an increase of 4% year-over-year. Nearly a quarter (22%) of brands have no plans to insource, which remains unchanged compared to 2018.

While the U.S. has the biggest share of programmatic spending, European markets are farther ahead in the insourcing of programmatic. This may be due to the General Data Protection Regulation (GDPR) requiring European organizations to create new processes to comply with the legislation. As brands face more regulations from Europe, and from California with the California Consumer Privacy Act (CCPA), enforcement of which began on July 1st, the organizations that build and manage a robust customer database will best weather the storm.

Europe: France, Germany, Italy, Portugal, Spain, and UK

Europe is deeply entrenched in programmatic, with European countries’ share of digital ad spend greater than 80%. With GDPR implemented in the EU in May of 2018, Europe has been at the forefront of establishing regulations to protect consumer privacy and data. Almost three-quarters of European organizations (74%) have completely or partially moved programmatic in-house, which is more than organizations in either the U.S. or Latin America.

Latin America: Brazil and Mexico

Brazil shows the most growth of any market analyzed in the report. In fact, it will soon usurp Australia as the fifth largest market for video.

In Latin America, organizations are executing more programmatic with a direct contract with a DSP versus in-house.

Relative to other regions, LatAm has been late to enacting data protection guidelines. Only a few countries in Latin America have enacted legislation: Argentina, Colombia, Chile, Mexico, Peru, and Uruguay. Brazil’s new data protection law (LGPD), resembles the EU’s GDPR and comes into force in August 2020.

2020 International Report on Programmatic In-Housing

2020 U.S. Report on Programmatic In-Housing

2020 European Report on Programmatic In-Housing

2020 Latin America Report on Programmatic In-Housing