As the wheels of time turn, so too does the video advertising ecosystem. We are in the beginning stages of a transformative period in which video is becoming the most important and talked about form of advertising. It is changing not only how we use our smartphones, but also how we consume what we’ve traditionally called television. However, this evolution has made things fragmented and complex and it is in times like this that education becomes even more critical. Because of this, I’m excited to partner with IAB on the latest version of their Video Landscape Report . This report serves to simplify digital video while providing perspectives on the current state of the ecosystem by highlighting the opportunities, challenges, and emerging trends. It’s an invaluable resource that both buyers and sellers alike should familiarize themselves with in order to stay up to date with the digital video marketplace.

The growth of digital video remains evident. Time spent with digital video continues to grow every year and as a result, so does digital video revenue. In the latest version of the report, we see three major trends emerging that are helping drive the growth of digital video.

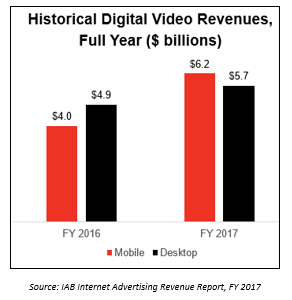

1. Mobile video is a dominant force. Mobile video is taking a greater share of total digital video consumption. Recent eMarketer reports show that people are spending 38 minutes a day with digital video on mobile versus 24 minutes on desktop/laptop and 25 minutes with other connected devices. Mobile video is also serving as the primary driver of digital video ad revenue growth – outpacing desktop video revenue for the first time in 2017 hitting $6.2 billion versus $5.7 billion for desktop. It will be interesting to see how the availability of 5G speed will transform and facilitate delivery. 5G will help eliminate buffering and lag time and truly enable us to have video experience anywhere and everywhere.

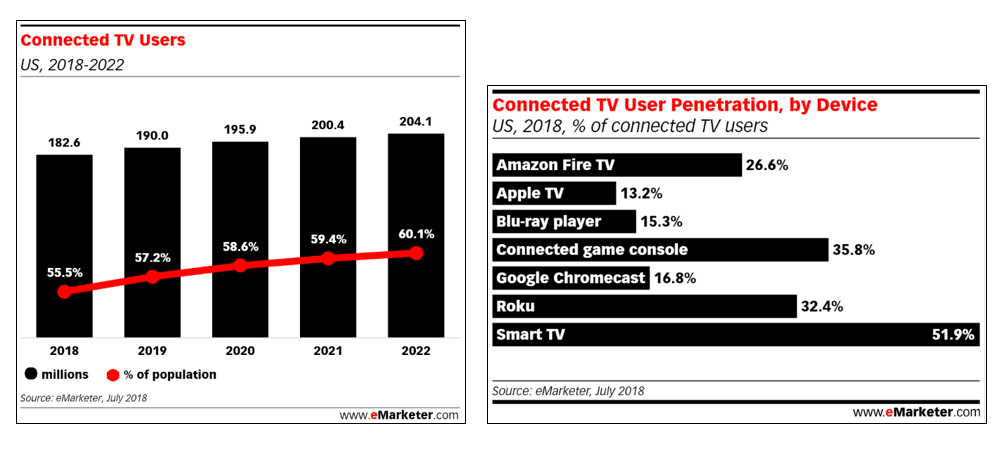

2.  Reach continues to grow within the OTT/CTV universe. U.S. connected TV users have reached 182.6 million in 2018 – comprising 55% of the US population. This is largely being driven by smart TV ownership, followed by connected game console and Roku ownership. This is an area that we believe will continue to grow and we are working to create an urgency about how we follow the consumer from traditional TV toward OTT. We want to refresh the way we invest in premium video and are placing a big emphasis on internal and client education about what the landscape is, how you access it, and best practices.

Reach continues to grow within the OTT/CTV universe. U.S. connected TV users have reached 182.6 million in 2018 – comprising 55% of the US population. This is largely being driven by smart TV ownership, followed by connected game console and Roku ownership. This is an area that we believe will continue to grow and we are working to create an urgency about how we follow the consumer from traditional TV toward OTT. We want to refresh the way we invest in premium video and are placing a big emphasis on internal and client education about what the landscape is, how you access it, and best practices.

3. With the rise of these consumer behaviors and new platforms, marketers are empowered to leverage creative innovation to develop one-to-one relationships with consumers. We are encouraging our clients to test different ad formats. The specific ad formats will ultimately depend on the advertiser and the campaign goals. However, in general, I do feel excited about interactive ads. With interactive ads, you can start to move the needle from awareness to consideration. In our initial testing, we are seeing that interactive ads can command much more than 30 seconds of lean-in engagement. However, it’s critical to approach measurement carefully for these new innovative video formats. Understanding the role of channel is paramount. Just because you can track conversion doesn’t mean you should measure it that way, as that behavior may not be native to the platform. This is something to keep in mind as you measure the success of a campaign.

As for what’s to come in 2019, I’m looking forward to see how new technology like voice search will impact the discoverability of content and how we will be able to personalize not only ads but content to enhance the consumer experience. The role of data and measurement will continue to evolve and is key for us in understanding the behavior between different video opportunities, especially in OTT/CTV. Whatever comes next, the good news is video is on the rise. However, it will require cross-industry collaboration to help create guidance and standardization to address both the specific and far reaching needs of the many diverse constituents.